The death and disruption wrought by COVID-19 is calamitous. The bad news is that climate change will be worse. It is easy to forget that 2020 began with Australia burning in a brutal wildfire season. Like the current pandemic, Australia’s disaster was predicted years in advance by ecological science. As we slowly emerge from the corona virus crisis it is worth asking: why has action on climate change been glacial while actual glaciers are rapidly melting?

We are University of Victoria (UVic) researchers with the Corporate Mapping Project (CMP)—a partnership of university and community-based researchers investigating the power and influence of the oil, gas, and coal industries in Western Canada (UVic is the academic home for the CMP). One of the CMP’s main findings is that the extensive power of the fossil fuel industry is the primary obstruction to much needed climate action. From funding outright denial to persistently lobbying decision-makers, the industry has been successful at stalling substantive climate policies.

As we slowly emerge from the corona virus crisis it is worth asking: why has action on climate change been glacial while actual glaciers are rapidly melting?

In addition to these direct forms of obstruction, the fossil fuel industry also influences decision-making more informally through its reach into various organizations of civil society, from think tanks and industry associations to universities. This reach is often accomplished through interlocking directorates—the practice where members of a corporate board of directors serve on the boards of multiple other organizations. Industry executives and directors who also sit on the governance boards of civil-society organizations and public institutions, such as universities, create an influence network whose many threads of communication and collaboration enable the fossil fuel industry to advance its profit-driven concerns disguised as being in the ‘public interest.’

University of British Columbia (UBC) Divests

Despite this significant industry obstruction, climate action still remains possible thanks to the tireless efforts of popular movements. In January, UBC became the largest Canadian university to divest from fossil fuel companies. When institutions of record such as UBC divest for moral and financial reasons, that helps to challenge the social licence of oil, gas, and coal companies, creating more space for politicians to pass the ambitious transition legislation—such as a Green New Deal—required to avoid 1.5 degrees Celsius warming.

Here the industry has the capacity and incentive to seek seats on decision-making tables across the country, ensuring that its interests are seen as Canada’s interests.

When UBC divested they joined Université Laval, Université du Québec à Montréal, and Concordia University as Canadian leaders. Most recently the University of Guelph has announced a divestment plan. Despite these successes, most Canadian universities lag behind their counterparts in other regions. For example, half of U.K. universities have divested. The regions with the highest concentration of divestment decisions—such as the U.K., California, and New York state—are not major fossil fuel producers. Canada, on the other hand, is the world’s fourth largest producer. Here the industry has the capacity and incentive to seek seats on decision-making tables across the country, ensuring that its interests are seen as Canada’s interests. This influence peddling also extends to universities.

Oil and gas go to class

In 2016, Dalhousie’s then Dean of Science, Chris Moore, raised concerns when a senior executive at Shell, a major donor to Dalhousie, told him that the company was “monitoring the university divestment movement closely and would look unfavorably on any university that divested in regard to future investment.” Dalhousie continues to block divestment despite a vibrant student campaign.

Likewise, a 2017 report from the Canadian Association of University Teachers found that oil company interference compromised academic integrity at the University of Calgary. The controversy centred on Enbridge’s push to remove the director of the university’s “Enbridge Centre for Corporate Sustainability” for publicly challenging the company. At the time, then University of Calgary president, Elizabeth Cannon, held a highly remunerated position on Enbridge’s board. She now sits on the board of Canadian Natural Resources Limited, one of the largest oil sands producers. The divestment movement at the University of Calgary never stood a chance.

Given this history of industry obstruction, especially in fossil fuel producing provinces, the UBC decision is especially impressive (British Columbia is Canada’s second largest fracked gas producer behind Alberta). This victory at UBC prompted a question for us at the University of Victoria: why not here when the divestment movements at UVic and UBC have been operative for the same time period, using similar tactics?

Turning the spotlight inwards

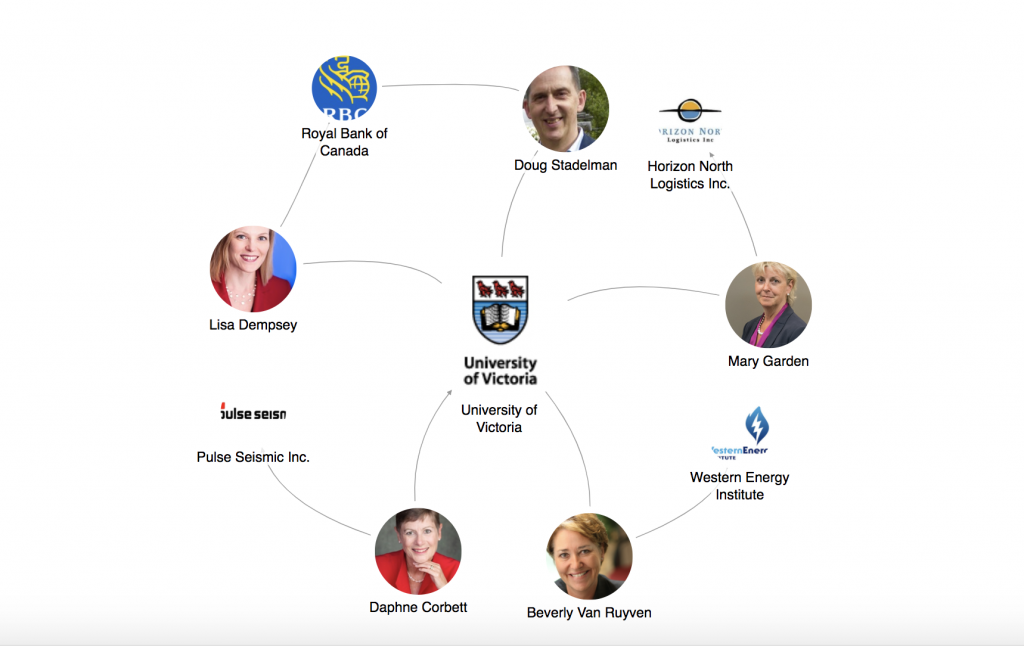

To answer this question we turned the Corporate Mapping Project inwards, asking if industry influence might be informing UVic’s opposition, despite deep support for divestment from both students and faculty. Likewise, we wanted to see if an absence of industry obstruction was a factor in the UBC success story. We looked particularly at the UVic and UBC governing boards, since these are the bodies that control the endowment funds targeted by divestment campaigners ($1.7 billion for UBC and $470 million for UVic).

We looked to see if members of these boards had linkages with fossil fuel companies and/or major Canadian banks. Why banks? Because they are major investors in the Canadian oil patch, with a vested interest in seeing fossil fuel production grow. The Royal Bank of Canada (RBC), for example, is the second largest investor in Canada’s fossil fuel sector and its number one lender. Industry-affiliated board members do not, as a rule, actively promote the firms to which they are tied. Rather, they bring to the table a world view, shaped by their own commitment to the fossil fuel industry, that presents a cultural barrier to serious climate action.

Given this history of industry obstruction, especially in fossil fuel producing provinces, the UBC decision is especially impressive.

We found no significant linkages to banks or fossil fuel companies on UBC’s Board, with most members involved in law, real estate, hospitality, non-profit or tech. The chair of UBC’s board, Michael Korenberg, did serve on the board of a coal exporting company up until 2017. He doesn’t mention this affiliation on his UBC or LinkedIn pages. He was also formerly on the board of HSBC Canada (a major bank), whose parent company recently announced that it would stop financing new coal and oil sand developments. Maybe this decision is why Korenberg is keeping his former connection to coal “in the ground.” From all accounts, Korenberg was a strong supporter of UBC’s divestment push that was led by brilliant student campaigners with the organization UBCC350.

A spill of influence on the Left Coast

The scene is different across the Salish sea. Unlike UBC, UVic has two governing boards, one for the broader university and one specifically charged with overseeing the endowment fund. The main board is responsible for appointing the endowment board, and both are significantly connected to fossil fuels and finance.

For example, the chair of the endowment board, Mary Garden, is also a director for Horizon North Logistics, which builds modular camps for oil and gas production. These camps, often referred to as “man camps,” have been implicated in gendered colonial violence and the crisis of missing and murdered Indigenous women. Horizon North built the camps for Coastal GasLink on sovereign Wet’suwet’en territory, where in February the RCMP conducted a militarized 5-day siege that sparked solidarity actions across the country.

Likewise, Horizon North Logistics also built the camps at the Kearl Lake oil sands facility in northern Alberta that has been linked to a large COVID-19 outbreak. Because the Alberta government has not restricted fly-in fly-out workers, the outbreak has already been linked to the deaths of two Dene elders in Saskatchewan, along with cases in British Columbia, Nova Scotia, Newfoundland and Labrador.

Unlike UBC, UVic has two governing boards… and both are significantly connected to fossil fuels and finance.

Mary Garden’s position as chair of the endowment board is a potential obstruction to divestment at UVic since she represents a company whose profits are tied to the fossil fuel industry. The connections do not end there. Also on the endowment board (which includes eight members from outside UVic) sits Lisa Dempsey, who is a VP and investment counsellor for RBC, and Doug Stadelman who until 2018 was an RBC VP for Canadian equities. Recall that RBC is the world’s second largest investor in the Canadian fossil fuel sector.

There are fossil fuel linkages on UVic’s main Board of Governors as well. Daphne Corbett was a director with Pulse Seismic until 2018, a company whose mission is to provide “seismic data to the western Canadian energy sector.” And Beverly Van Ruyven is the former chair of the Western Energy Institute, “a trade association serving the electric and natural gas industries throughout the Western United States and Canada.”

We in the divestment movement at UVic—a university that claims sustainability and reconciliation leadership—have been swimming against a tide of fracked gas and bitumen. Petitions, sit-ins and successful votes by faculty and students have gone nowhere. Why? Perhaps it is due to the influence that the industry and their financiers wield on UVic’s governing boards. This influence might also help explain why UVic remains committed to investing in fossil fuel companies, even while those investments are losing millions of dollars.

UVic losing millions

UVic lost $4 million on their Canadian fossil fuel investments between March 2018 and March 2019. Even before COVID-19, UVic’s fossil energy investments were delivering a -17% rate of return (RoR). In contrast, the Toronto Stock Exchange’s fossil free index had a +7.9% RoR that same year. The fossil energy sector was the worst performing segment of the stock market in 2018-19. No longer can anyone credibly claim that divestment is financially imprudent. The reverse may now be true. Recently, Norway’s sovereign wealth fund—one of the world’s largest investors—announced that it would no longer invest in Suncor, Imperial Oil, Canadian Natural Resources, and Cenovus due to their high greenhouse gas emissions. UVic is invested in three of these four companies. Perhaps UVic is staying the course due to the material and ideological interests of those sitting on its governing boards?

We don’t know why the UBC board is largely free of fossil fuel connections. But this difference puts UBC at a distinct advantage in managing the moral and financial risks of climate change.

External members to Canadian university governing boards are mostly appointed by provincial governments. Both the UBC and UVic external board members that we examined were appointed by the previous BC Liberal government. We don’t know why the UBC board is largely free of fossil fuel connections. But this difference puts UBC at a distinct advantage in managing the moral and financial risks of climate change.

The financial outlook for fossil fuels has been made even grimmer by COVID-19. So far this year UVic has lost another $9 million on their fossil energy investments. There will be a bounce once economic activity resumes, but financial analysts such as CNBC’s Jim Cramer were warning about a “death knell phase” for fossil fuel stocks—even before the pandemic drove a dagger through balance sheets, soaking them in red.

UVic’s oily board is the norm

UVic sits in Elizabeth May’s federal riding. Even here on the Left Coast the fossil fuel industry and their financiers sit around decision-making tables. This is a major financial and ecological risk because industry interests are at odds with the rapid energy transition required. The industry influence alive at UVic is replicated across the country.

Consider the Canada Pension Plan, which has billions invested in fossil energy despite the clear headwinds facing the industry. Why? Perhaps it is because the board that governs the CPP is deeply entangled with the fossil fuel industry.

It is important to scrutinize those who oversee our collective wealth, examining how their interests and ideologies hamper or enable energy transition—at universities, in government, and in the wider society. UBC’s successful divestment movement is a hopeful sign that if we can remove industry obstruction, then a livable future for all remains possible.