The oil and gas royalty regime in British Columbia needs a major overhaul.

The re-elected NDP promised during the election campaign to review oil and gas royalties and credits. In the context of a climate emergency the need for a managed wind-down is urgent. Despite “natural” gas being a finite greenhouse-gas-generating fossil fuel, the royalty regime BC applies for the extraction of natural gas is aimed at encouraging and ramping up production, not winding the industry down.

A central public policy objective should be to maximize the returns to the public from the extraction of this collectively owned resource, while reducing subsidies that incentivize production on more marginal sites.

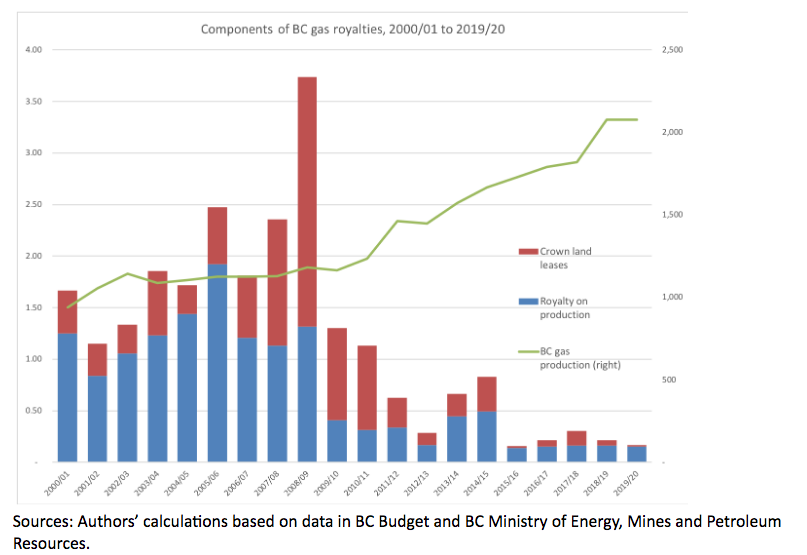

Royalties differ from, say, corporate income taxes, in that they reflect a return to the Treasury when private development of a public resource takes place. There are two components to gas royalties in BC. First, companies bid in auctions for land tenure rights for exploration, and second, they pay a royalty on actual production. Together, the royalty regime is supposed to capture a fair share of the economic rent or profits from the private exploitation of a public resource. If only.

Over a decade ago, BC received large annual royalty revenues from its growing natural gas sector. This is no longer the case. Total BC gas production has increased substantially in recent years (top green line, right axis), up about 84% in 2019 compared to 2007. Public revenues, on the other hand, have fallen substantially. Considering both royalties paid on gas production and leases of Crown land, returns to the public hit a record $3.7 billion in 2008/2009 (see bars) compared to an average of $150 million per year since 2015/16.

BC’s royalty regime is primarily based on the price of gas rather than the volume produced. Low market prices in recent years have been a critical factor behind lower royalty revenues. From a peak of $8-9 per thousand cubic feet in 2008 gas prices dropped well below $2 in 2016 and 2017 in BC’s principal export market, Alberta.

A second part of the decline is the expanded use of subsidies/incentives in the form of royalty credits introduced primarily to encourage fracking. BC Budget 2020 estimates these credits at $381 million in 2019/20, consuming some 71% of gross gas royalties. Use of royalty credits is forecast to grow to almost half a billion dollars by 2022/23. Credits can be stockpiled to be claimed against future royalties owing. Freedom of information requests made by CCPA’s Ben Parfitt revealed that some 26 companies garnered just over $700 million in deep well credits in 2017/18 alone. The BC Public Accounts cites outstanding deep well credits of $2.6 billion as of the end of the 2018/19 fiscal year.

Royalty reform is clearly needed to ensure public benefits and reduce incentives for companies to tap marginal wells or those with high environmental costs. In light of current low gas prices across North America and worldwide, BC is effectively subsidizing production that would not otherwise occur. This increased supply puts further downward pressure on gas prices, and royalties back to the public are a pittance relative to record volumes extracted. We are basically giving away a finite resource.

Key directions for reform include:

- A moratorium on issuing new leases/tenures—this could include restrictions on extensions of existing leases and reclamation of existing licenses that expire. Policy could also consider buying back some of the outstanding leases to be consistent with a carbon budget approach. Some of this may happen as a result of corporate decisions. For example, Imperial Oil walked away from some BC Crown leases in 2016, leading to a write down of $289 million, which had been anticipated as supply for an LNG megaproject that was cancelled.1

- Increase royalty rates and set a minimum royalty per unit extracted—the current system relies too much on market prices in a context of over-production of gas in North America, with very low prices making the return to the public very small. In addition, higher royalties per unit are tantamount to the inclusion of environmental and social costs of extraction, processing and transportation (e.g., “social cost of carbon” associated with extraction and eventual combustion). This would affect decision-making by companies such that marginal wells/deposits would be abandoned first.

- Use increased royalty revenues to support worker transitions and community transitions related to a managed wind down. This would include investing in economic diversification, green infrastructure and remediation activities. In the spirit of reconciliation, provision for royalty sharing should be made to honour the rights and title held over BC lands by First Nations.

- Eliminate subsidies for fracking—credits against royalties for fracking and associated infrastructure in the gas industry and similar credits for coal mining should be removed. Along with these reforms, other subsidies to fossil fuel industries should be phased out. The “heritage” industrial electricity rates through BC Hydro and low industrial usage charges for water also represent subsidies to the industry. The development of new sources of power generation and new transmission lines for resource projects, where such costs are spread across all ratepayers, are essentially new subsidies to fossil fuel industries.

- Shift to public ownership—companies invest in order to grow and generate revenues and profits for investors, a business model that may well be inconsistent with the wind down we are seeking. An alternative would be to use a Crown energy corporation as a focal point for the transition. This would also enable full economic rents to be captured (as with Norway), and could better support a just transition for workers and communities as described above. This would likely mean buying leases from existing corporate holders, or taking them back from companies that do not wish to produce under the new regime outlined here, and taking over extraction and processing operations ourselves, with a wind-down schedule hardwired into the business plan of the crown corporation.

Note

- Canadian Press, “Imperial Oil reports fourth-quarter loss on northern gas project writedowns”, Feb 2, 2018, https://business.financialpost.com/pmn/business-pmn/imperial-oil-reports-fourth-quarter-loss-revenue-down-from-year-ago

Author: Marc Lee and Seth Klein

Marc Lee is a Senior Economist at the CCPA’s BC Office and a co-investigator with the Corporate Mapping Project (CMP). Marc is Co-Director of the Climate Justice Project, a research partnership with UBC’s School of Community and Regional Planning that examines the links between climate change policies and social justice.

Seth Klein is a research associate with and the former Director of the Canadian Centre for Policy Alternatives, BC Office. His research deals primarily with welfare policy, poverty, inequality and economic security. A social activist for over 30 years and a former teacher, Seth holds a BA in international relations, a BEd from the University of Toronto and an MA in political science from Simon Fraser University.